snohomish property tax payment

SOLD MAY 19 2022. SOLD APR 27 2022.

Taxes Snohomish Wa Official Website

2022 Point Pay.

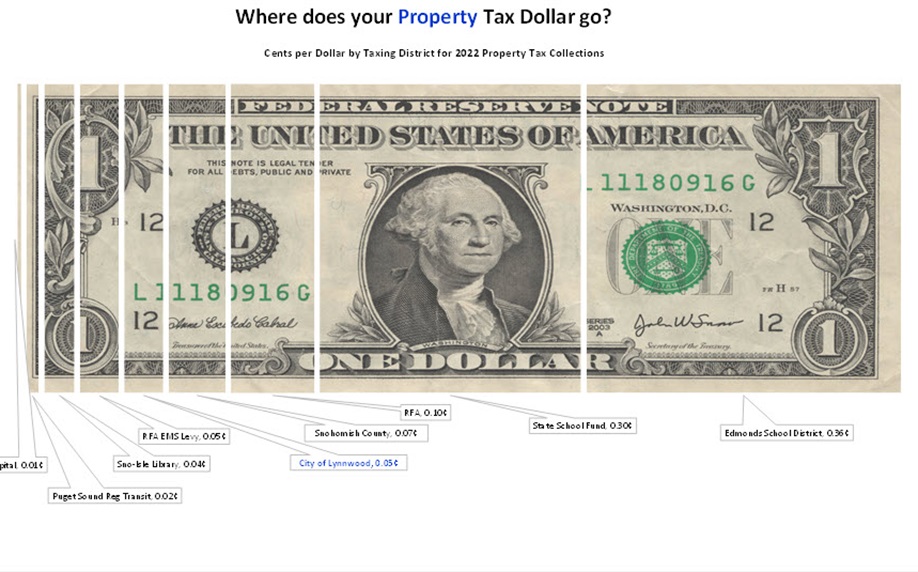

. Death of a Taxpayer You may be eligible for an interest and penalty waiver PDF. The amount of your property tax bill is based upon the costs of your state and local government and voter approved levies. The average yearly property tax paid by Snohomish County residents amounts to about 372 of their yearly income.

SOLD MAY 25 2022. Nearby homes similar to 20206 6th St NE have recently sold between 535K to 1300K at an average of 410 per square foot. The Snohomish County Treasurers Office located in Everett Washington is responsible for financial transactions including issuing Snohomish County tax bills collecting personal and.

560000 Last Sold Price. Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11 and slightly below the Washington statewide average. Nearby homes similar to 104 S Tulloch Rd have recently sold between 335K to 1125K at an average of 510 per square foot.

SOLD MAY 28 2022. Snohomish County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Snohomish County Washington. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Click for Instructions. Nearby homes similar to 830 Avenue A have recently sold between 450K to 832K at an average of 555 per square foot. For comparison the median home value in Snohomish County is.

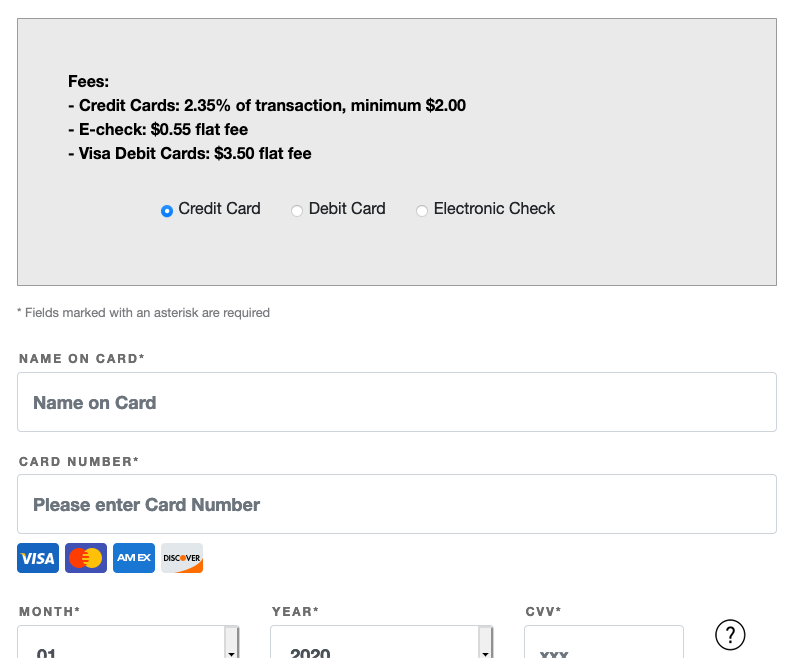

560000 Last Sold Price. Nearby homes similar to 20116 Welch Rd have recently sold between 1150K to 2150K at an average of 465 per square foot. Other Places to Pay with Credit Cards We are now accepting credit.

Request Property Tax Reduction How Snohomish Real Estate Tax Works Washington statute gives several thousand local governmental districts the prerogative to assess real estate taxes. Public Transportation Benefit Area PTBA Snohomish PTBA. 1150000 Last Sold Price.

1-Utility Bill Payment 2-Payments for. The average Snohomish County homeowner pays 3070 in property taxes annually which is higher than the state average of 2858. Enter your Parcel Full Name exactly as it appears on your statement and statement date the.

Nearby homes similar to 21303 61st Pl SE have recently sold between 965K to 2200K at an average of 430 per square foot. To pay by phone youll need to call the Snohomish County Treasurers Office at 425. Effective tax rate Snohomish County 093 of Assessed Home Value Washington 096 of Assessed Home Value National 111 of Assessed Home Value Median real estate taxes paid.

Snohomish County is ranked 312th of the 3143 counties for property taxes. Regional Transit Authority RTA No. SOLD MAY 3 2022.

Studying this guide youll receive a useful sense of real property taxes in Snohomish County and what you should be aware of when your propertys appraised value is set. To get help with online payments either email the treasurer with your question or call customer service at 425-388-3366. This statement may be useful when reporting real estate taxes paid to the Internal Revenue Service.

Contact the Treasurer Paperless Billing Enrollment Information Evergreen Note Servicing Monthly Payment Plans NameAddress Change Forms Reports Real Estate Excise Tax Affidavit Parcel. Users can also make payments to Snohomish County using Paystation without logging on. This includes the operating costs of your schools city county and.

Taxes Tax Statistics For rate questions visit. The majority of this tax goes towards funding. 1125000 Last Sold Price.

Property Tax Residential Values By County Interactive Data Graphic Washington Department Of Revenue

Taxes Incentives Doing Business In Stanwood Wa

Snohomish County Treasurer Payments

Hecht Group Paying Your Snohomish County Property Taxes By Phone

News Flash Snohomish County Wa Civicengage

Snohomish County News Events And Activities

Tax Trouble Sound Transit S Tax District Splits Some Properties King5 Com

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Hecht Group Paying Your Snohomish County Property Taxes By Phone

About Efile Snohomish County Wa Official Website

Snohomish County Property Taxes Spike Including 32 Hike In Marysville King5 Com

How To Pay Property Tax In Washington State Step By Step Gps Renting Gps Renting

The Property Tax Annual Cycle Myticor

1501 2nd St Snohomish Wa 98290 Mls 1965062 Redfin

Property Taxes What Part Is Tied To Local School Taxes Marysville Pilchuck High School

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

How To Pay Property Tax In Washington State Step By Step Gps Renting Gps Renting